Smart Financial Ideas for High School Seniors

On the way of becoming financially literate: essential tips for high school students.

June 3, 2023

When you got your first paycheck, what did you do with it? As students are approaching their senior year, they face more crucial financial decisions in life. While learning all the financial life skills on their own can be boring and confusing, YLHS’s business academy provides lessons for students to understand the banking basics, filing taxes, creating a savings plan, managing financial accounts, and insurance through a real-world simulation and teaching different methods you can use to protect your money.

There are many resources and information online, but it is hard to distinguish what is the right thing to do with your money. Finding an in-person financial institution can be a great first step.

Moreover, establish a saving plan or create a budget. You might have seen some memes about ‘doing something on a budget,’ which means saving money monthly until achieving your financial goals. Students should evaluate their current financial situation. This should include their income (allowance, part-time job, or other income), expenses, (housing, transportation, food, entertainment, clothing, personal care, etc.), school expenses, and savings/investments. Once students have a clear picture of their financial standing, it will be much easier to decide how much money they need to save up. Students can also join the 529 plan, which is a savings plan that allows anyone to save for higher education.

Furthermore, learn about credit and debit cards. As seniors become adults, they find out money becomes increasingly necessary. What do you usually use to pay? Cash can be easily lost or stolen and it is less secure than cards. Rather than cash, which card, credit or debit, is the best choice for you? When you are using money on a credit card, you are borrowing money from the bank and will need to pay it back later with interest, while when you use a debit card, you are using the money you already put into the account for use.

Additionally, research financial aid and scholarships. Explore grants, scholarships, and student loans and understand the eligibility requirements and repayment terms.

Not only that, after the student has enough money in his/her savings account for an emergency, financial goals, or any purpose, they can learn about investing. A savings account does keep your money safe and students can also earn interest. But investing can earn much more interest. Although there are many ways online to teach people how to invest, students should seek guidance from financial experts because it involves the possibility of losing some or all the money that is put in.

April 15th is the national tax day in the United States. To learn how to file your own taxes, there are various resources. It’s always a good idea to consult a qualified tax professional or accountant who can provide you with personalized advice.

Last but not least, spending habits are important to discuss. High school seniors should cultivate responsible spending habits on their needs and want. Considering if you really need something for life before you buy it will impact your financial goals. Developing good spending habits early, as right now, will contribute to financial stability in the future.

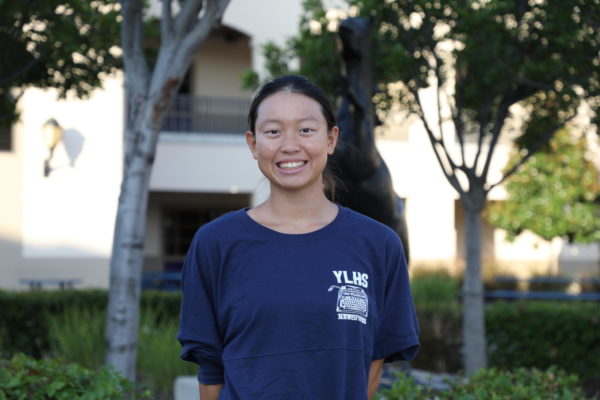

In conclusion, during summer break, high school seniors and even other grade-level students should start learning the skills to make smart financial decisions. Precious Hoang (9), a student who learned financial lessons through the business class said, “A benefit for me to start learning finance early on is so I can be educated for the future. I’ll be able to know what to do if I’m in debt, how to fill out tax forms, how to open checks and savings accounts, etc. These skills will help me through college and when I get a job.”