College is…Expensive

Columbia University, ranked #18 in the 2022-2023 Best Colleges in National Universities, has a $65,524 tuition cost.

February 8, 2023

As college acceptances start coming out, seniors at Yorba Linda High School will have to decide on which college is best to attend for them. The price of the university’s tuition is one of the main factors that affects the decision of the next step in their academic journey. Harvey Mudd is the most expensive college now and is $20,000 more expensive than the priciest college 12 years ago. Although college has such a high price tag, it is an experience many students want to have after graduating high school.

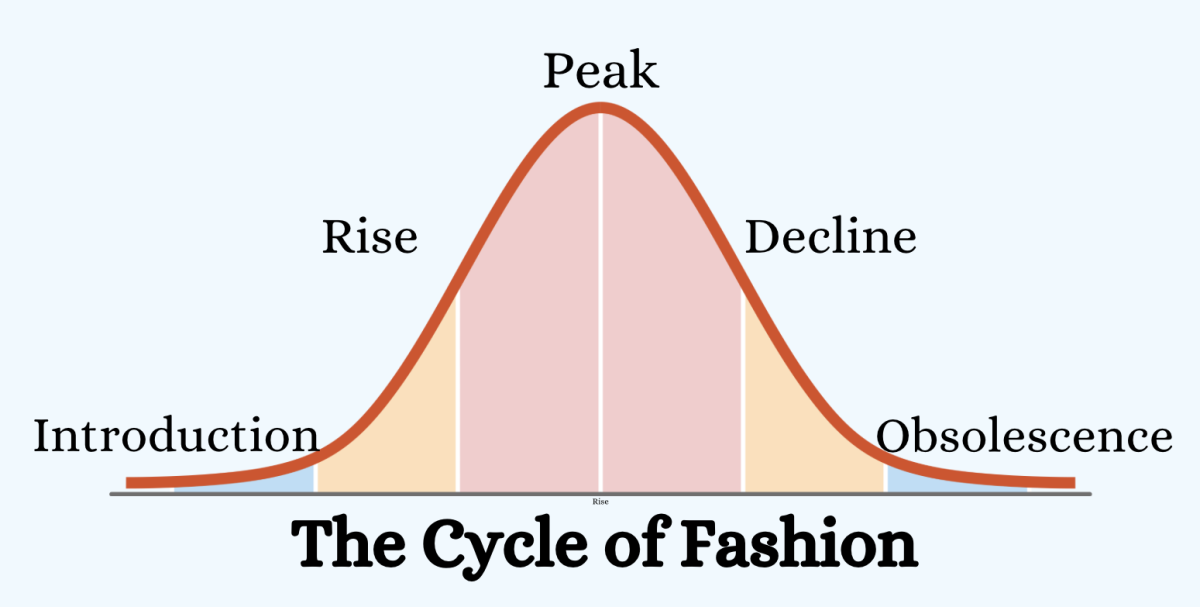

Even though the value of a college degree has been decreasing, the demand to attend has not gone down, in fact, it is only rising. Based upon the economic principles of supply and demand, the price of a good rises when more demand exists for the good. More students who want to go to college means that the more the cost of college increases. Since 1980, the tuition price has doubled from an average of $10,000 to $21,000 per year.

Other factors that contribute to the charge of higher education are an increase in financial aid, which might seem counter-intuitive. In 1978, Congress passed the Middle Income Student Assistance Act, providing increased student aid for low and middle-income students. The bill gave more generous Basic Educational Opportunity Grant Pell grants for the less fortunate students. In addition, 1.5 million middle-income students were able to be eligible for the Basic Grants Program. Due to the increase in financial help, colleges took this as a sign to raise fees, further increasing the tuition.

Staggering tuition costs leave many students in debt. The average student debt is $29,800 after graduation and a collective national student debt of $1.5 trillion across 45 million Americans. One out of every five adults will be paying off their college debt for another 20 years after graduation. This effects adults today, statistics saying millennials are facing financial struggles that were not present in the generations before. An example of this is adults having to save longer for housing. With money consistently going to student-loan debt, saving up for a big purchase like a house takes longer.

College can provide students with experience and knowledge that they will need for their future career or occupation. — Sophia Mou (9)

Despite this high price of going to a university, it is a goal of many to accomplish. Sophia Mou (9) explains, “College can provide students with experience and knowledge that they will need for their future career or occupation.”