Why are Some People Pushing for a Recession?

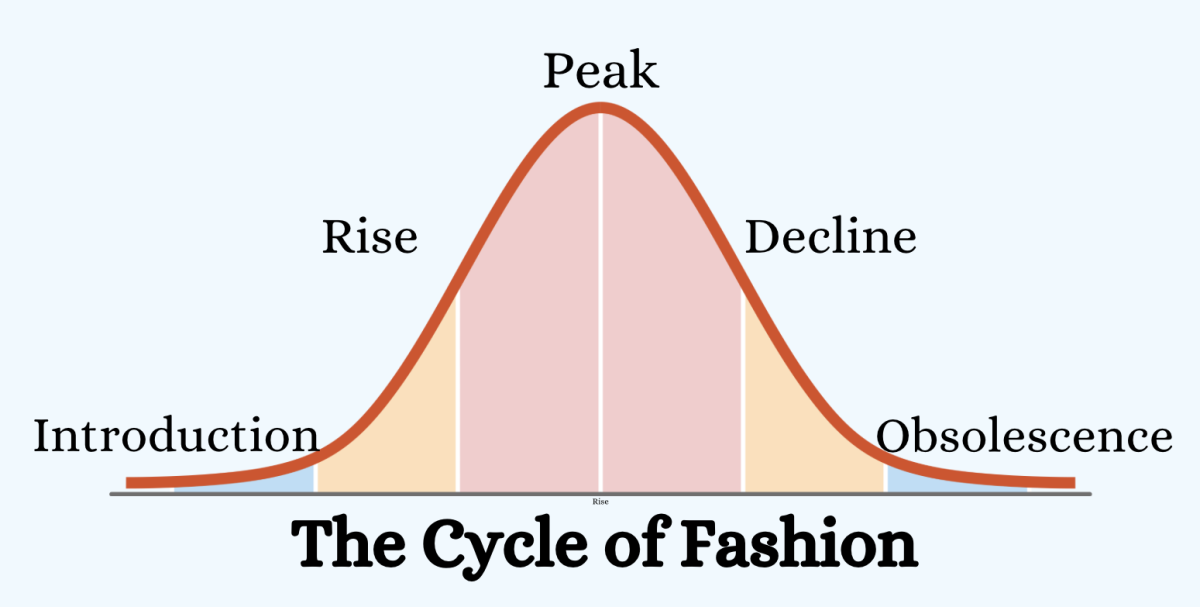

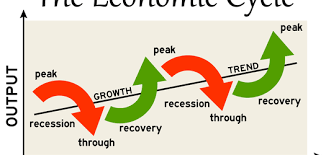

This graph outlines the economic cycle and how constant it is- while a recession sounds like a scary reality, it is in fact something expected and even helpful.

January 23, 2023

Before explaining why people are pushing for the recession, I must explain what a recession exactly is. A recession is a “business cycle contraction when there is a general decline in economic activity.” Recessions occur when there is a widespread drop in non-discretionary spending. The first thing that will make a recession is the immediate and intense uptake in prices called inflation. Inflation is a general increase in the prices of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The first step in combating inflation is to raise interest rates. What this does is make borrowing money more difficult, which deters people from spending money that they don’t have.

The Federal Reserve had been slowly doing this since 2021. At first, it looked like they had succeeded. Many thought inflation would slow. But then, Russia’s prolonged invasion of Ukraine caused a plethora of economic problems, and inflation picked up new momentum. This is when the recession officially began. First, the stock market started to drop. This obliterated a lot of capital all at once. Second, companies and consumers grew nervous about the future. Economic anxiety makes people decide to hold on to their money and stop spending. These kinds of decisions can help lower inflation. But that didn’t happen this time. Russia’s invasion of Ukraine made gas prices go up, which made the cost of so many other things go up as well. Recession risks went up, too. As people became more nervous about the future, it started to look like a recession was inevitable. Companies started preparing to pause hiring and start a round of layoffs. Because prices continued to go up, the Fed was forced to increase interest rates even more.

Inflation has definitely become too much to bear and I do think that a lowering of demand is necessary. — Adil Ismail (11)

The recession has now started, and the largest effects will be seen around the holiday season. When the seasonal round of hiring does not occur, prices on big-ticket items such as TVs and furniture will be lower than since the pandemic started. Once this occurs, the economy will come to a stop of sorts. People’s spending will sway towards items they need versus items they want because of unemployment and high-interest rates. In fact, on September 21, the Fed raised interest rates up to 3.00-3.25%, which was the highest since 2008, when the last recession occurred (Vox News). This evening out is exactly what the Fed wants. We want the economy to come to a point where prices are reasonable enough that people can start to buy more and when this happens companies will start to rehire. The goal is that eventually, we will reach that perfect balance. The desired position will, for the most part, erase a majority of the economic animosities that we are facing at the moment. Essentially, this “desirable position” is unemployment at 3.7% and inflation at just around 2%.

When asked about this, Adil Ismail(11) discussed how “inflation has definitely become too much to bear and I do think that a lowering of demand is necessary.” This quote supports how economic policies encouraging recession must be implemented in order to reduce costs. Although this cycle may be difficult to understand, it is not too out of the ordinary and these fluctuations, though extreme, are what drive the economy. A recession seems to be bad on paper but when looking at it through a wider lens one can understand why it actually isn’t.