Are We Approaching a Recession?

Many people are worried that a large recession is on the horizon.

June 7, 2022

The U.S. added nearly half a million jobs in March putting the unemployment rate at 3.6%. The Dow Jones industrial average is at 6% of its record high. U.S. households have accumulated roughly $2.5 trillion in excess savings throughout the pandemic (Fortune). Still, predictions of an impending recession continue to spread on Wall Street. Billionaire investors, former Federal Reserve officials, and even investment banks have repeatedly warned about the economy in 2023. So, what’s driving the recent set of alarming economic projections?

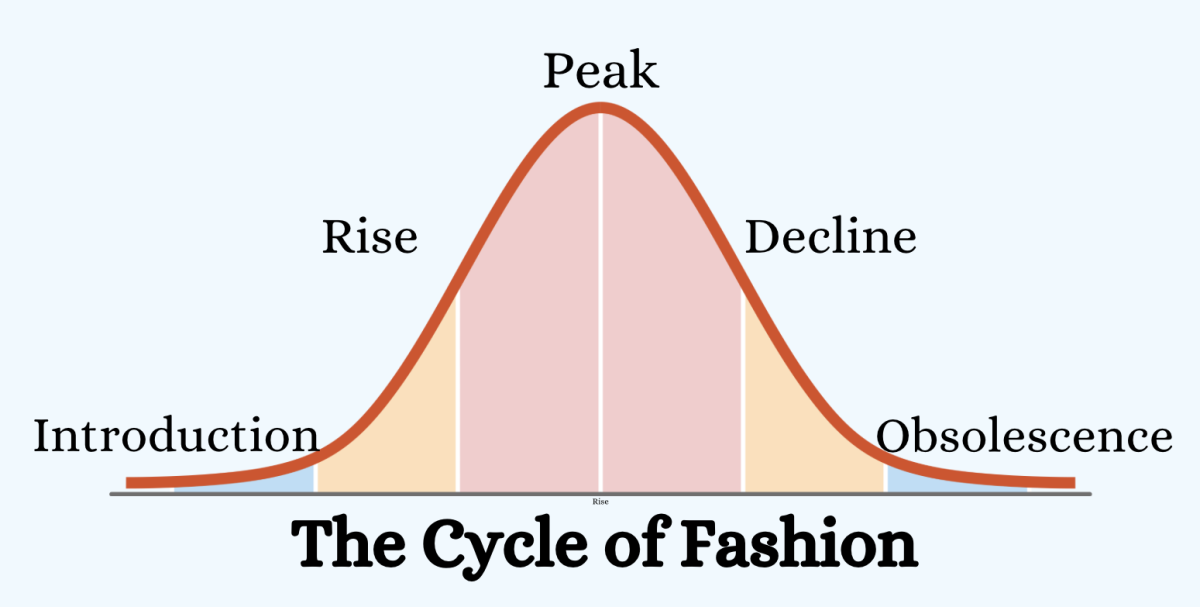

One of people’s biggest worries as of late has been the stock market. The stock market has fallen 18.7% since its peak on January 3 (Forbes). This drop has caused millions of people to lose out on millions of dollars, which is certainly concerning. But, when you look at recessions of the past and how the stock market behaved it was very different. This provides some reassurance and tells people not to focus on the state of the stock market alone.

Even then, a recession is certainly possible. Interest rates are rising, energy costs are up, and buyers cannot keep up with their recent spending. Inflation is running higher than wage growth at 8.5-percent, and the increase in March was the largest 12-month advance since December 1981. However, the economy is still reaping the rewards of past stimulus, both government spending and easy monetary policy. Stimulus works through the economy over time, and we are still relishing the benefits of last year’s money creation. The change in monetary procedure will be felt mostly in 2023, and even then it will be a gradual change (Fortune)

Some believe it’s a matter of historical comparison. Former Treasury Secretary Lawrence Summers discussed in a recent Washington Post op-ed that current economic conditions are undeniably reminiscent of prior pre-recession periods in U.S. history. “Over the past 75 years, every time inflation has exceeded 4% and unemployment has gone below 5%, the U.S. economy has gone into a recession within two years,” Summers corresponded. As a result of the unemployment and inflation rates Summers now sees an 80% chance of a U.S. recession by next year. Another thing to note is U.S. real GDP (gross domestic product) growth is now expected to slow to an annual rate of 1.7% in the first quarter of 2022, compared with 7% annual growth seen in the fourth quarter of 2020. Adil Ismail (10) commented, “I don’t know much about the economy but with inflation so high it must come down at some point.”