Gas Prices and Cars

The Toyota Prius, a hybrid electric car, utilizes both fuel and electricity for power, enabling a better fuel economy (the greater number of miles a car can travel using a specific amount of fuel).

January 13, 2022

What brings so many cars to the Costco gas station? Down by Savi Ranch Parkway, the lot’s gas pumps boast constant patterns of vehicles lining up for a fill; on some occasions, lines spill out onto the passing lane of adjacent Crystal Drive to wait impatiently. The clear answer is gasoline price. According to the Costco website, their station by Savi Ranch charges $4.25 a gallon, beating out nearby gas stations averaging prices around $4.70 (AAA Gas Prices).

Prices in stations by Yorba Linda High mostly reflect the California state average of $4.71; per AAA Gas Prices — a website that measures gas price averages nationwide — Cali ranks first in having the most expensive average state gas price, with Hawaii reaching second with a $4.35 state average. Oklahoma tops that list of having the lowest state gas price average at $2.95, with Texas behind at a close second of $2.98.

Let’s examine gas prices around Yorba Linda High. The nearest station, a Chevron down Fairmont in the Trader Joe’s plaza, charges $4.90 per gallon of regular gasoline and $5.04 for midgrade gas. A Mobil station on Yorba Linda Boulevard posts $4.80 as its price for regular gasoline and $5.00 on the dollar for midgrade gas. On the corner of Rose Drive and Imperial Highway ARCO pumps charge $4.40 per regular grade gallon and $4.60 for midgrade gas.

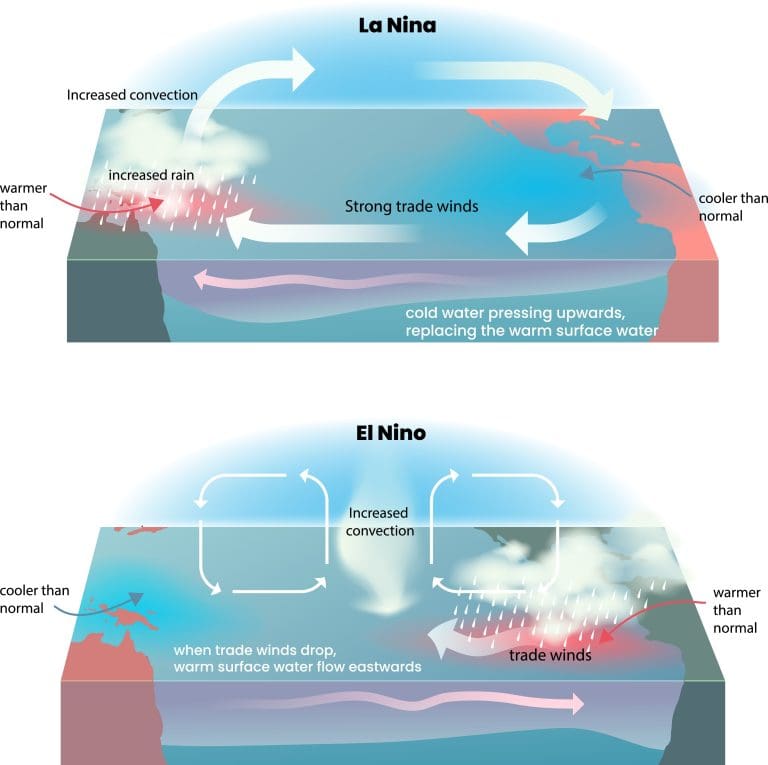

California’s average price of over $4.71 is a relatively far cry from the lowest state average — Oklahoma’s $2.95. Crude oil is expensive in itself as demand steadily returns after the pandemic yet worldwide supply of fuel drops in areas like Europe and China, states SFGATE.

But why do Oklahomans pay less than Californians when crude oil is equally expensive for the both of us? Cali’s higher averages are chiefly a result of our higher gas taxes and environmental fees. The American Petroleum Institute’s data on petroleum taxes reveals that the Golden State slaps the highest taxes on a gallon of gasoline within the country. Currently, the API states, Californians pay 85.38 cents per gallon for tax — including state excise taxes, federal excise taxes, sales taxes, and production taxes. The runner-up for costliest gas taxes, Hawaii, pays 68.57 cents per gallon. Also, with California’s focus on addressing environmental concerns, gas producers are required to refine cleaner burning petroleum to meet a state standard, driving up gas production to be more expensive than other states.

Some families turn to hybrid or electric vehicles for their reduced usage of petroleum. This is a change that is often advertised to decrease the need for a weekly gasoline allowance, making the option more attractive to customers. It’s also often touted to be a cleaner alternative to fuel-burning cars, which can release chemical compounds into the air through combustion. However, Mrs. Pilkenton (Staff), who teaches AP Environmental Science, explains that electric cars are not the failsafe solution to vehicular pollution. “We might burn less gasoline, but the production of electric cars damages the earth because we’re releasing chemicals into the ground, which can spread through water and earth and harm ecosystems,” she explains. “[Hybrid electric vehicles are] a step in the right direction, though.”

California is a beautiful place to live, but costly all the same. Gas prices are reflective of just one tradeoff to living in the Golden State. To get the most value for your gas money, weigh the pros and cons of starting your ignition and ask again if that car trip is worth more than 4 and a half dollars per gallon.