Cost of a Cashless Society

Although going cashless is beneficial for businesses, there is still a lot to discuss about the detrimental effects this system could have on Americans.

January 23, 2019

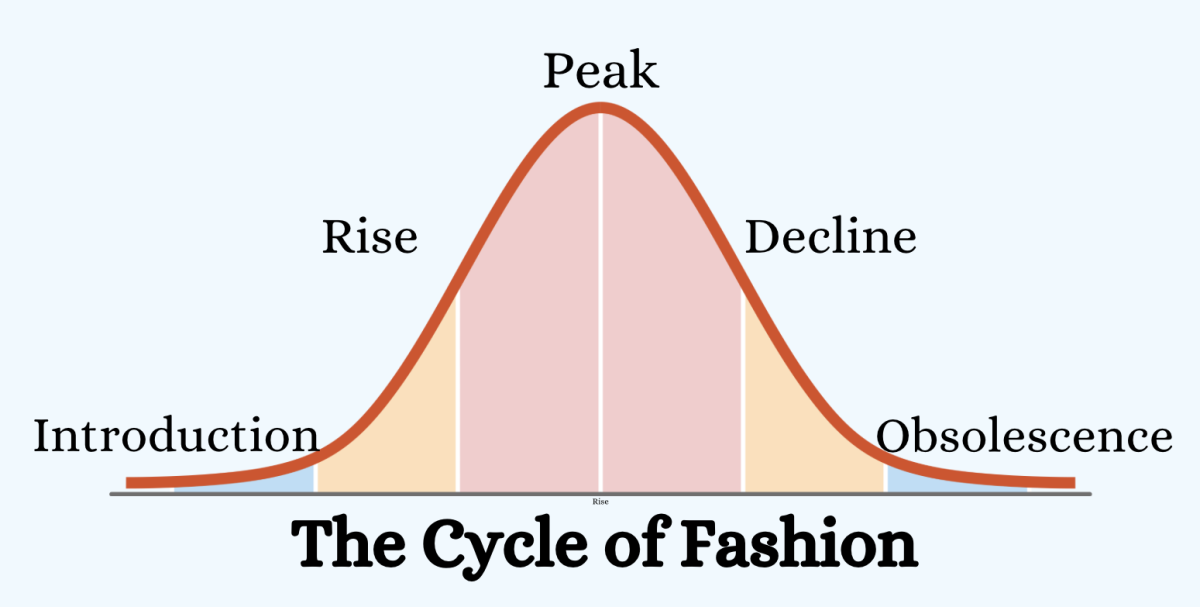

In recent years, more and more methods of payment has been offered from businesses all over America. From credit cards to Apple Pay to cryptocurrency, buying things has never been easier. Although the United States’ usage of technology to pay for goods and services isn’t as developed as China’s nearly cashless society, this country is headed in the same direction.

There has been a recent trend of companies and business shifting away from hard money and towards cards or apps. For example, Dos Toros, a restaurant chain with locations scattered throughout New York, has been fully cash free for about a year now. Co-founder Leo Kremer claims that the number of the shop’s customers that use cash has fallen to just 15 percent at the beginning of 2018, and at that point, the inconveniences that come with using cash was just not worth the effort anymore.

Going cashless makes it easier for businesses because it saves them time and money from “employee training, banking fees, armored-truck pickups, and the occasional robbery” (Slate). It also benefits the middleman: credit card companies. A couple of years ago, Visa even announced that they would be giving out a $10,000 reward to 50 businesses that would give up cash altogether. The way Stacy Mitchell, co-director of the Institute for Local Self-Reliance, sees it, a “cashless future… benefits Wall Street [because] they can charge swipe fees of two to three percent not because that’s what the service actually costs, but because they have monopoly power.”

If all these people benefit from this new system, why would it be bad? Well, people fail to realize that, according to a 2017 survey by the Federal Deposit Insurance Corporation, around “7 percent of U.S. households, or 8.4 million, are unbanked, meaning that no one in the household possesses a checking or savings account, [while] another 19 percent are underbanked, indicating that they have a bank account but still rely on financial products such as payday loans.” For many Americans, cash is still the most convenient form of payment- if not the only way of payment.

Not only does a cashless society exclude the lower class, but it also poses a problem for all different groups of people. Since credit cards often come with a minimum age requirement, younger people won’t have as much access to this resource as others. The growing popularity of using technology for digital payments also excludes the elderly, as many aren’t familiar with the likes of Apple Pay.

Hard cash still remains “legal tender for all debts, public and private,” as it says so right on the bill. However, you technically don’t have debt until you’ve made a deal with someone (Forbes). Through this reasoning, courts have often sided with sellers who refuse coins or currency “on a reasonable basis,” a Treasury spokesperson explained, “such as when doing so increases efficiency, prevents incompatibility problems with the equipment employed to accept or count the money, or improves security.”

Ashley Bui-Tran (12) is familiar with all the options she can pay with. “I use all types of payments such as debit card, cash, and Apple Pay. Using my phone to pay is super convenient because I always have it on me,” she says. “However, I don’t think businesses should completely stop accepting cash because some people can’t afford to have that happen.”

All in all, excluding cash makes things way easier for companies to manage, and it speeds up transactions and maximizes efficiency, but limiting the range of choices for everyday people who already have fewer options than everyone else is detrimental to American society and with contribute to the ever growing class divide.