What is The Debt Ceiling?

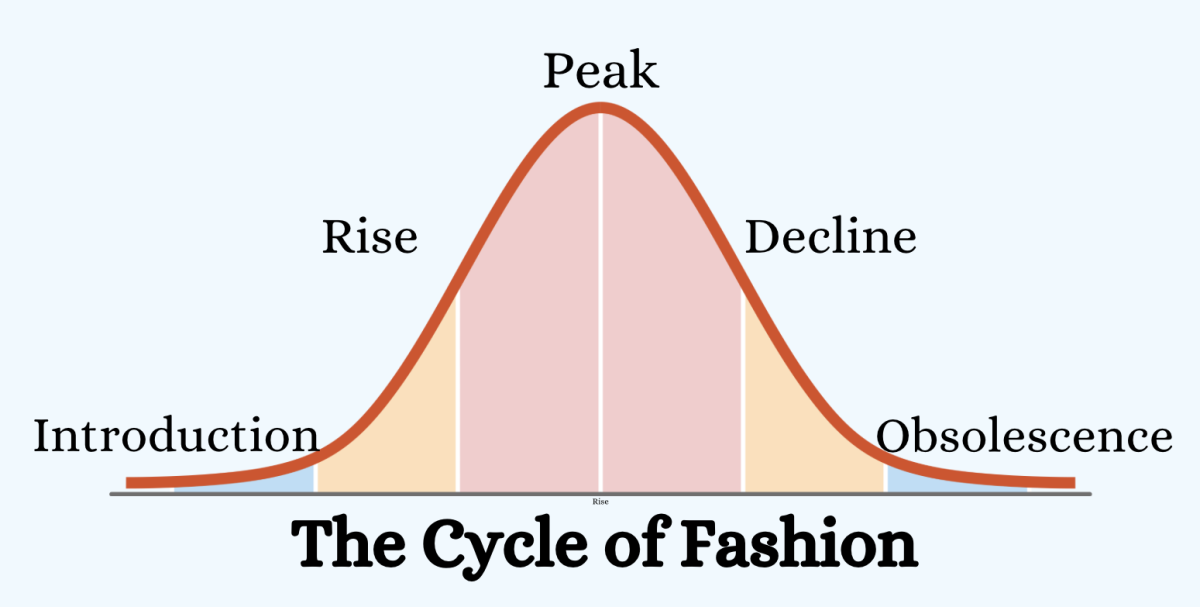

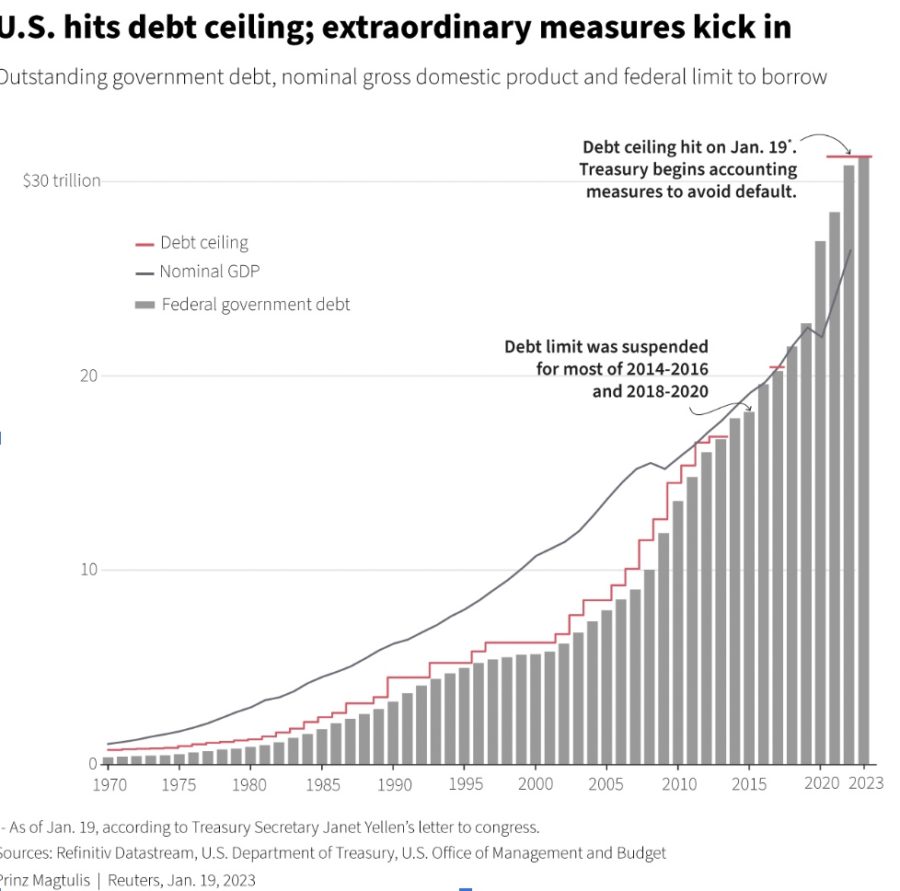

The graph above shows how we hit and exceeded our debt ceiling over time.

March 6, 2023

If you are an avid listener of the news, you have probably heard the term “debt ceiling” a lot, and if you are like me you probably don’t know what that means. The technical meaning of this is: “the legislative limit on the amount of national debt that the US Treasury can incur, thus limiting how much money the federal government may pay on the debt they already borrowed”(home-treasury). Even with this technical definition, it’s still a little bit hard to understand. The simplified version of this is essentially that Congress has put a limit on how much national debt the country can have. It simply allows the government to finance existing legal commitments that Congresses and presidents of both parties have made in the past. Our debt has become so large that since the debt limit is not increased, there will be disastrous economic consequences. In response to this, on December 16, 2021, legislators raised the debt limit by $2.5 trillion to a total of $31.4 trillion.

The reason why you’ve been hearing this on the news a lot is that on January 19, 2023, that limit was reached. The Treasury announced a “debt issuance suspension period” during which, under current law, it can take well-established “extraordinary measures” to borrow additional funds without breaching the debt ceiling. This is very important because reaching the debt limit has catastrophic economic consequences.

I have never heard of the debt ceiling, but I am interested to learn more.

— Hannah Jebelli (11)

The Congressional Budget Office projects that, if the debt limit remains unchanged, the government’s ability to borrow using extraordinary measures will be depleted between July and September 2023. The projected exhaustion date is uncertain because the timing and amount of revenue can differ. In particular, income tax receipts in April can be more or less than the amount estimated. If those receipts fall short of the estimated amount, the extraordinary measures can be exhausted sooner, and the US Treasury might run out of funds before July 2023.

This looming economic issue has also raised questions regarding government shutdowns. Federal funding isn’t set to run out until the end of September, but lawmakers are already bracing for the possibility of a budget lapse and partial government shutdown due to the renewed partisan fighting over spending priorities. There are rumors of a series of budget demands in the next annual appropriations process, including holding overall government spending, passing appropriations bills individually instead of in a package, and concessions from the White House in exchange for increasing the country’s debt limit.A student at YLHS Hannah Jebelli (11) commented that she “has never heard of the debt ceiling and is interested to learn more.” I think that this is a common theme with a lot of people and that it is important to be educated on governmental policies such as this one.