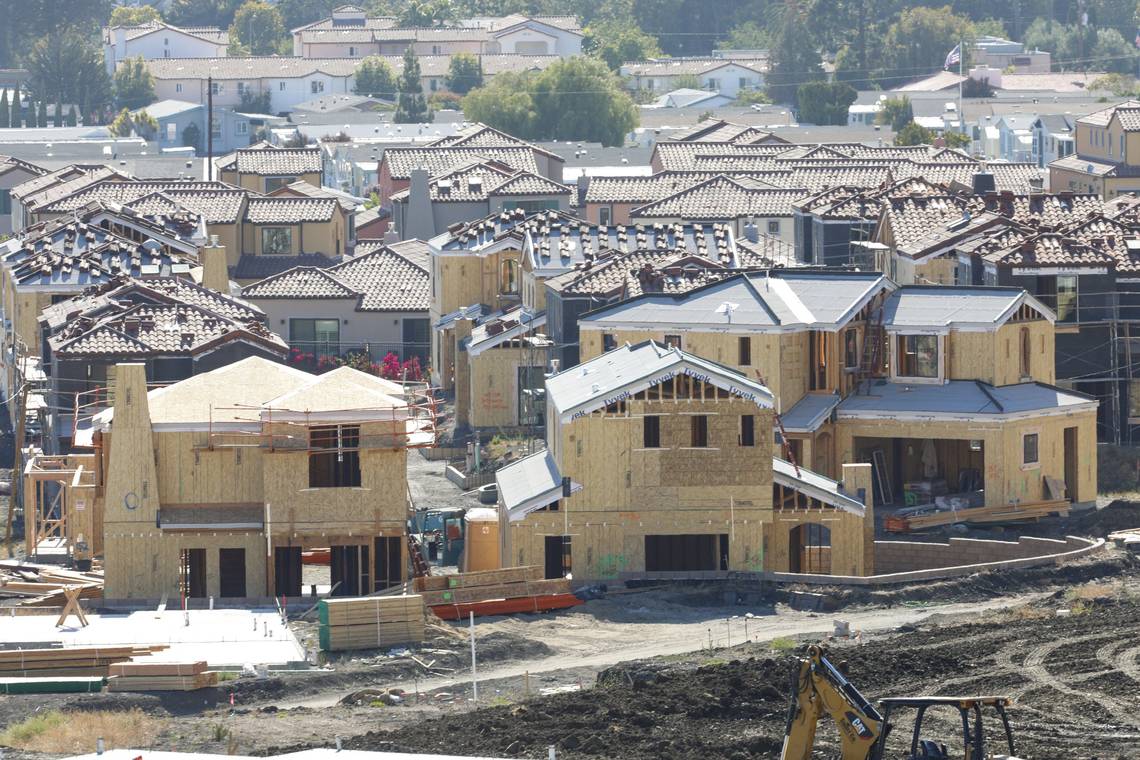

The stock market might sound like something only financial experts can understand, but in reality, it’s a powerful tool anyone can use to grow their savings. At its core, the stock market is a marketplace where publicly traded companies’ shares are bought and sold. Think of a share as a tiny piece of a company—when one purchases, he or she would own a part of that company. The value of the bought share can rise or fall depending on how well the company performs and how much demand there is for its stock. Over time, the stock market has helped millions save with big life goals like college, retirement, or even starting a business.

The stock market operates through exchanges, such as the New York Stock Exchange (NYSE) or Nasdaq, which act like giant digital trading floors. Companies list their shares on these exchanges through a process called an initial public offering (IPO), where they sell stock to raise money for growth. Once the stocks are listed, everyday investors can buy and sell them through brokerage accounts. The price of each stock changes constantly, influenced by factors like the company’s financial health, industry trends, global events, and investor sentiment. For example, if a company releases an exciting new product, its stock price might increase because people believe it will make the company more profitable. On the contrary, bad news, like financial losses or a scandal, can cause a stock’s price to drop as investors lose confidence.

For someone new to investing, it might help to imagine the stock market like an auction house. When many people want to buy a stock, they bid higher prices to outcompete others, causing the price to go up. On the opposite side of the spectrum, if more people want to sell than buy, the price goes down. These movements can seem random in the short term, but they often reflect larger patterns of growth, innovation, and risk over time that the invested company takes.

How Do People Start Investing?

Beginning an investment journey involves clear goal-setting and gradual steps. Identifying a purpose for investing—such as saving for retirement, funding education, or building an emergency fund—is key in helping determine the most effective strategy for that situation. Another critical consideration is determining how much money can be comfortably set aside without affecting daily expenses. Starting small is often the best approach, especially for beginners.

Selecting the right investments is crucial. Exchange-traded funds (ETFs) are a popular choice for beginners due to their diversity. They bundle together a range of stocks, reducing the risk associated with investing in individual companies. For those interested in specific industries or companies, individual stocks offer an opportunity for more targeted investments but require thorough research to minimize risks.

Opening a brokerage account is the next step. Many platforms, such as Fidelity, Vanguard, and Charles Schwab, provide accessible and user-friendly investment managing tools. Some platforms also include resources like tutorials and practice accounts (also known as paper trading) to help beginners gain confidence before committing real money.

Investing in modern times is not only limited to those with substantial funds. Many brokerages now allow small investments, enabling consistent money flow into an account over time. This consistency combined with the power of compounding can lead to significant long-term growth. Patience is a fundamental principle in investing, as markets naturally experience fluctuations. Staying confident and committed to long-term goals is necessary in what could initially seem to be a chaotic market.

Some Starting Advice to Consider:

While there are many ways to trade and find the most profitable investments, beginners should start by knowing the following as a good way to start one’s journey in the stock market.

- Doing Research: Before buying a stock, learn about the company’s performance, products, and plans. A company with strong growth and a solid reputation is often a better choice.

- Diversifying the Portfolio: Placing all of one’s money into one stock is not a great idea. By spreading investments across different industries and companies, someone can better protect him or herself from major losses.

- Avoid Emotional Decisions: It’s easy to panic when stock prices drop, but remember that the market naturally goes through ups and downs. Staying focused on long-term goals is essential.

- Start Early: The earlier the investor starts placing money and investing, the more time the money has to grow. This is thanks to compounding, where the earnings generate even more profits over time.

- Seek Advice if Needed: If one is unsure where to start, video tutorials online are a great place to start. Often, there is no need to find a stock analyst for advice, and conjoining information across multiple sources would be sufficient for making good financial decisions.

Why Save for the Future?

Investing isn’t just about growing money—it’s about preparing for life’s challenges. Whether the investor plans to pay for college, buy a home, start a business, or retire comfortably, saving now sets the stage for these future opportunities. By investing, the money makes additional money, steadily increasing in value over time rather than sitting in a savings account and not even keeping up with inflation. Alan Fedak (10), an investing enthusiast, commented, “The stock market has been ruthless in the past, but once I understood it, it became my closest friend.” Investing early encourages many to develop a savings account that could be reliably used in the future when needed. Compounding allows earnings to generate additional earnings, creating a snowball effect where the initial investment grows exponentially over time. For example, if an investor invests $1,000 at an annual return rate of 7%, his or her money could double in 10 years, even if no additional money was added to the account. This power is why starting early is so important—the longer the money has to grow, the greater the results.

Beyond the financial benefits, saving and investing provide security and peace of mind. Emergencies, like unexpected medical bills or job loss, are easier to navigate when there is a financial cushion. Additionally, knowing how to progress toward goals can reduce stress and allow one to focus on enjoying the present. Even if there is not a big budget to start with, beginning the investment journey today can set one on a path to achieving financial independence and stability earlier.

By understanding the basics of the stock market and following smart investment practices, maintaining money for a safer financial future would not seem so unattainable. The key is to start now, stay informed, and remain patient as investments grow. So why wait? Open that brokerage account, make the first investment, and watch the money grow.

Melody Sutanto • Dec 5, 2024 at 7:25 AM

Really good and thorough article !