Saving Money

Stop blowing your money on unnecessary spends. The sooner you start saving, the better.

March 29, 2022

Saving money is a widespread concept from saving spare change to putting aside a portion of money from paychecks each month. However, what does this mean for teenagers? For us, the idea of saving money isn’t a large concern. So…why is it so important to watch how we spend our money?

As high school students, we have the desire to buy things. Maybe you are saving up to buy a new car, go on a shopping spree, or even an expensive dinner with friends. But, as teenagers, we need to start understanding how difficult it is to make money and the consequences of overspending, which can lead to early onset debt.

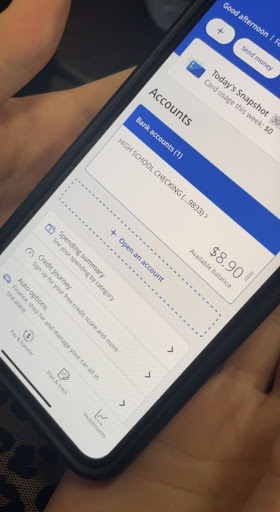

I, a sophomore, have come to an early understanding about spending. This was the result of spending excessive amounts until my credit card and debit card were frozen.

“Saving money is difficult. There are a lot of expenses in my day to day life such as paying for gas, food, and groceries. These expenses make it a lot harder to save up. So in order to put money into my bank account, I have to work a job. The only downside to this is, it takes time out of my week that I could be putting into school or sports. But, in the end, I guess it is worth it since it allows me to spend money on things that I really want,” Cate Roehling (10).

So, how can one avoid such complications? For starters, us teenagers can start by limiting the amount of weekly spending. Since, lavish spending on friends and extracurricular activities, along with necessary expenses on gas, groceries, and food can start to add up. A weekly spending limit allows for us to control the amount of money that is leaving our pockets.

Next, it is smart to start paying with cash as opposed to credit cards. Some people view credit cards as ‘fake money’, meaning that due to the fact that they can’t see the money, it’s not real. Paying with cash, it makes it easier to track the spending since you can physically see the money leaving your pockets.

Life is expensive, and saving money is not easy for anyone, but by taking the incentive to start saving at a younger age, it will lessen the difficulty of it in the future.