Elon Musk Has Too Much Power.

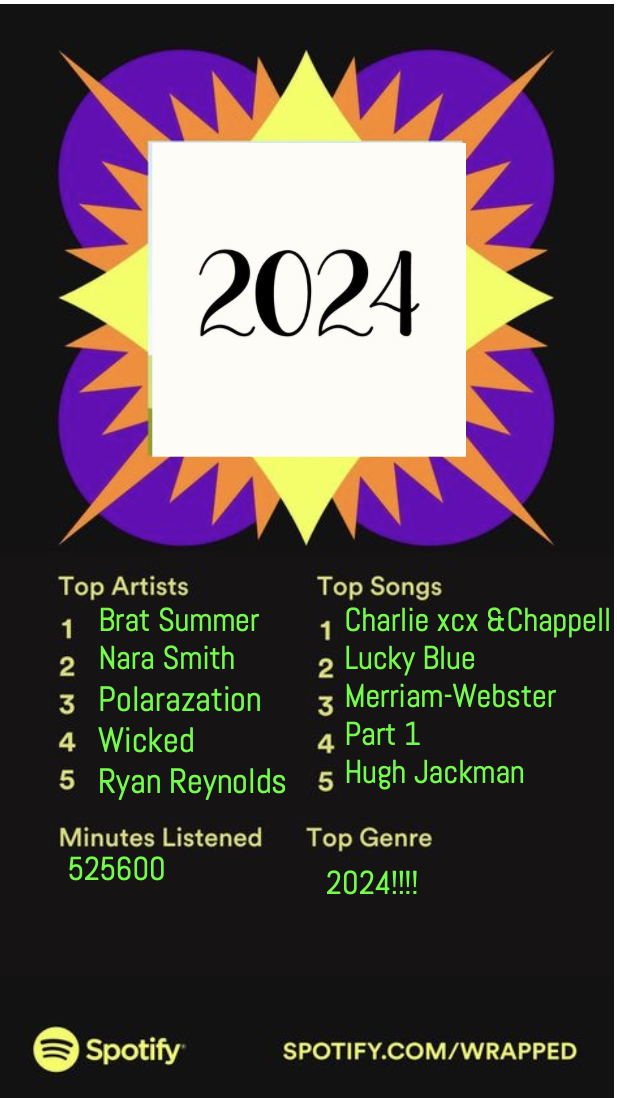

The “Floki Frunkpuppy” image that resulted in the SHIB rise of nearly 700%.

November 8, 2021

Elon Musk Tweeted a picture of his Shiba Inu puppy in early October with the caption “Floki Frunkpuppy.” The cryptocurrency known as “Shiba Inu coin” skyrocketed over 300% in just a few days after the Tweet. Investors began to push for Shiba Inu coin to be added to popular trading app Robinhood, further intensifying the SHIB frenzy. When compared to the beginning of October, the value of the coin now sits at just under 700% when compared to the beginning of the month.

Floki. Frunkpuppy. Seven. Hundred. Percent.

It’s clear that no person should have this immense power to manipulate the market, yet Elon Musk does. Dogecoin, a cryptocurrency created to be a knock-off satirical version of Bitcoin, rose to unbelievable heights almost solely off the back of Elon Musk. “Meme” coins suddenly became serious investment opportunities – again, mostly because of Musk. See the pattern?

Investing in a cryptocurrency works in a similar way to investing in a stock. It follows a basic supply and demand pattern – the more buyers, the higher the price is able to go. The price at which the buyer and seller agree to complete the transaction, therefore, is the price of the coin. More interest = the price goes up because of these supply and demand principles. I can sell my holding, now worth more, and make a profit.

Thus were born cryptocurrencies, most notably Bitcoin and Ethereum. Then Dogecoin was created in 2013 as a joke spinoff of Bitcoin, and after the success of Dogecoin, more spin offs of it were created. These even have their own term – altcoins.

All of this brings us back to Elon Musk and recent SHIB activity. If he wanted, there’s no doubt that he could bring the entire altcoin market crashing down on itself, or even bring down the price of a major legitimate cryptocurrency.

It’s important to understand how Musk differs from the typical “whale” of investments, in which a high-profile investor buys a stock and other follow suit. Rather, a Musk tweet like “Floki Frunkpuppy,” might cause an investor to think, “a lot of investors will be looking at this, and we will be watching each other because if more people buy, the price will go up. Thus, I should buy because that is what I think other people will do.”

Frankly, it makes little sense and I had to have my finance-savvy brother explain it to me because I didn’t get why people invest only because they thought others would, rather than looking at the face value of their investment.

And that’s the thing. Dogecoin and Shiba Inu Coin have zero face value. They are worth something only because of a fragile construct that’s purely made of believing in the crowd. Musk posts something negative about it, and though the coin is the same, the construct crumbles and the price plummets.

Derek Moore (9), says “It’s bad to let one man have so much power when it comes to someone’s finances.” Yes. Musk has too much power. But – and this is crucial – we can’t do anything about it. This is for one (and ½) critical reason(s).

- This was never Elon Musk’s fault. He never did anything. It was the plotting attitude, the “think-one-step-ahead” mindset of the investors that gave him so much power. It was the whole idea of investing in a cryptocurrency, where you follow that crowd that’s jumping off the cliff. I, for one, would jump if it would make me money.

- (ish) A direct violation of the First Amendment. But that’s for another day.

And that’s it. One man can bring the investments of millions down with a couple of characters and we can’t do anything about it. A pessimist would call it tragic.