Starting in 2031, California will require all high school students to take a financial literacy course before graduating. This new rule aims to help students better manage money and understand personal finance, a subject many feel has been neglected in schools. The decision was passed by the state legislature in 2023, sparking widespread discussions among students, parents, and teachers about its potential impact.

A 2020 report from the National Endowment for Financial Education found that 88% of Americans believe students should take financial literacy classes. However, only a few states have made such courses mandatory. California hopes that by implementing this requirement, students will leave high school with essential skills for budgeting, saving, and managing debt.

Tony Thurmond, California’s State Superintendent of Public Instruction, has been a strong advocate for this financial literacy initiative. In 2022, he helped secure $1.4 million in grants to support teacher training for these courses. “Providing financial literacy gives students a way of learning in very hands-on and practical ways,” said Thurmond. He believes that these courses not only prepare students for managing personal finances but also help engage them more deeply in other subjects by showing practical applications (California Department of Education). Thurmond’s efforts aim to better equip students to handle the financial challenges of adulthood, particularly in a state known for its high cost of living.

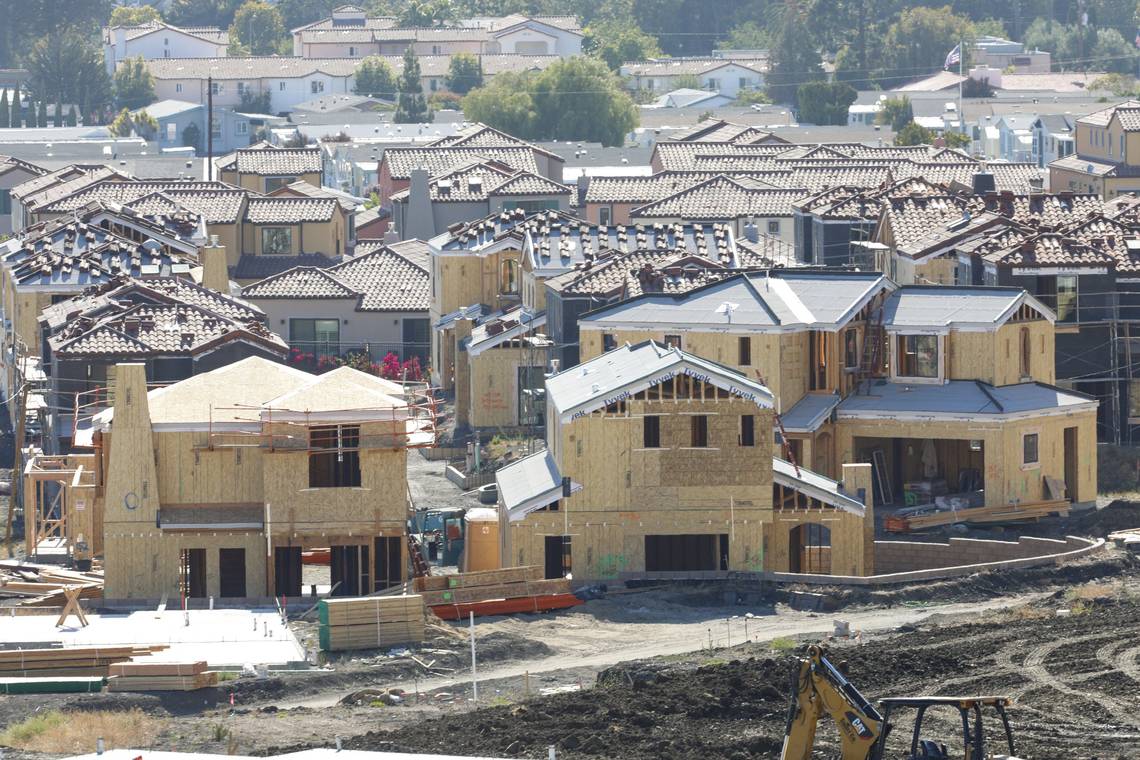

The new course will cover topics such as budgeting, saving, taxes, credit, loans, and interest rates. It will also touch on more advanced subjects like mortgages and retirement accounts. One highlight of the course is its hands-on approach, where students will complete practical assignments like preparing a mock tax return or creating a savings plan to practice real-world financial skills.

This class will replace one elective option and will be a full-year requirement. The curriculum is being developed in partnership with financial experts and educators to ensure it is practical and beneficial for students.

In response to the upcoming financial literacy requirement, students and teachers are discussing how this change could affect education and are also making predictions. One student, Leo Xing (10), stated, “…I would like to take this class if it was a thing because I want to learn about money before actually dealing with it. This can help me with my finance choices in the future and teach me responsibility when dealing with money.”

Financial literacy has become more crucial as young adults face rising costs for education, housing, and general living expenses. A 2021 study by the Financial Industry Regulatory Authority found that people who learn about finances early in life are more likely to save regularly and avoid high-interest debt (FINRA). By making financial literacy a core part of the high school experience, California is hoping to bridge the gap between academic learning and the real-world skills students need.

As schools prepare to roll out the new curriculum over the next few years, the state will provide resources and training to ensure teachers are well-equipped to teach the material. Though there are concerns about how this will affect elective options, many believe that this requirement is a step in the right direction to better prepare students for adult life.