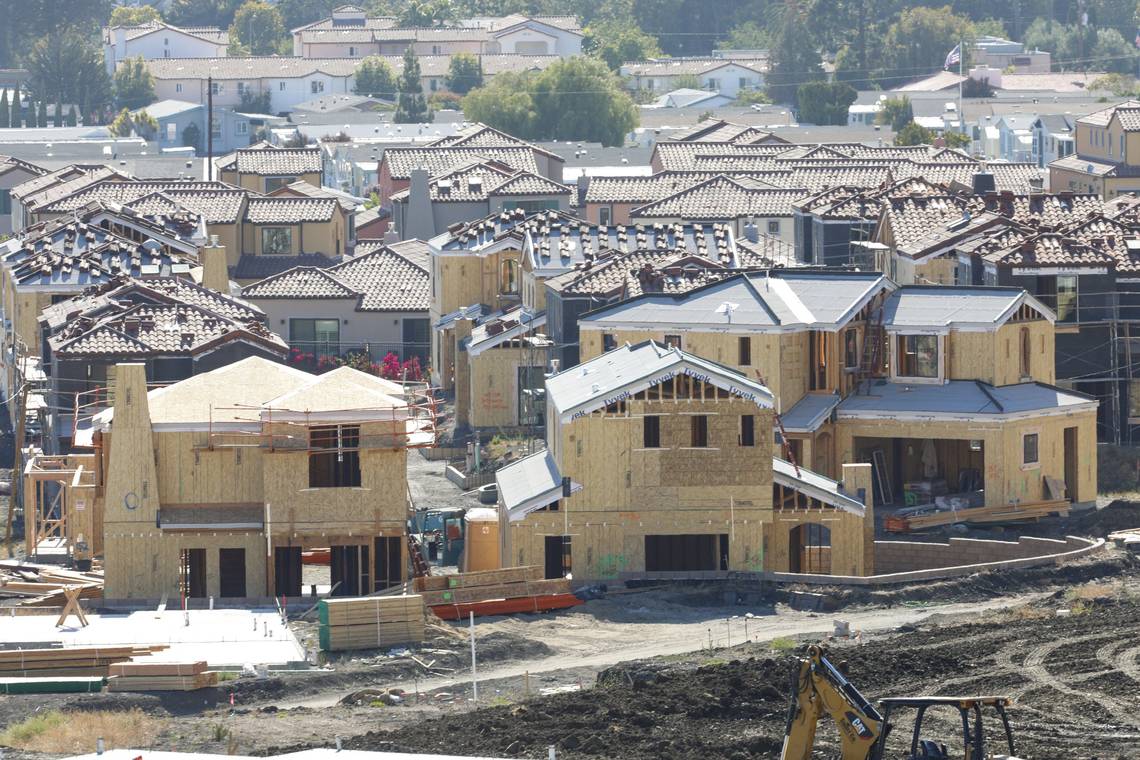

In today’s economy’s labyrinth, small businesses often find themselves navigating treacherous waters. While many factors contribute to their struggles, several prominent challenges stand out in the current landscape, leading to an unfortunate trend of closures and failures.

One significant issue haunting small businesses is the relentless wave of economic uncertainty. Small enterprises are left vulnerable to unpredictable market fluctuations, fluctuating consumer spending habits, and volatile supply chains. Unlike larger corporations with robust financial reserves and diversified revenue streams, small businesses lack the buffer to weather sudden storms. This uncertainty can paralyze decision-making, impede growth initiatives, and ultimately lead to failure.

Moreover, the digital revolution has altered the competitive landscape irreversibly. While technology offers unprecedented opportunities for efficiency and outreach, it also presents daunting challenges for traditional brick-and-mortar establishments. Small businesses must contend with the ever-looming threat of online giants, who possess the resources and reach to dominate various sectors. Adapting to digital transformation demands substantial investments in infrastructure, marketing, and cybersecurity, which can strain limited budgets and stretch thin resources.

Regulatory burdens further compound the woes of small businesses. Compliance with a labyrinthine web of regulations, taxes, and bureaucratic hurdles can be overwhelming, especially for enterprises with limited administrative capacity. Navigating this complex terrain not only consumes valuable time and resources but also stifles innovation and growth. Additionally, the uneven playing field created by regulatory disparities between small businesses and large corporations tilts the scales further against the former, exacerbating their struggles.

Access to capital remains a perennial challenge for small businesses, particularly in the aftermath of economic downturns. While banks and financial institutions may offer loans, stringent eligibility criteria and high interest rates often deter small enterprises from seeking funding. Moreover, risk-averse lenders may be hesitant to extend credit to businesses lacking extensive collateral or a proven track record, leaving many entrepreneurs stranded without the necessary resources to sustain or expand their operations.

Furthermore, the COVID-19 pandemic has inflicted unprecedented disruption and hardship upon small businesses worldwide. “Ever since 2020,” shares Maddie Hernandez (10), “I feel like stores and restaurants have been less and less busy! I’ve seen more businesses close down these past four years than I have in my entire lifetime.” Lockdowns, supply chain disruptions, and shifting consumer behaviors have forced many enterprises to shut their doors permanently. While government relief programs provided temporary respite for some, others fell through the cracks, exacerbating existing inequalities and vulnerabilities.

In conclusion, the plight of small businesses in today’s economy is a multifaceted dilemma with no easy solutions. From economic uncertainty and digital disruption to regulatory burdens and financial constraints, myriad challenges threaten the survival of these vital engines of innovation and prosperity. Addressing these issues requires a concerted effort from policymakers, industry stakeholders, and the broader community to foster an environment where small businesses can thrive and flourish.