Trump China Tariffs

The US steel industry is one of many industries that could be negatively impacted by Trump’s tariffs.

June 5, 2019

The stock market witnessed a drop after President Trump increased tariffs on China throughout the month of May. The United States increased tariffs from 10% to 25% on $200 billion of Chinese goods. The Dow had dropped 270 points Sunday evening, while S&P 500 and Nasdaq futures were down more than 1%. In May, he announced plans to impose a 25% tariff on $325bn of other Chinese goods.

On Monday, May 13th, the Dow dropped again. Asian markets have also acquired a large loss with the Nikkei (N225) dropping around 0.5% and the Shanghai Composite (SHCOMP) falling nearly 1%. The increased tariffs have evoked fear amongst Wall Street investors of an escalating trade war between the United States and China with both of them raising tariffs.

The increased tariffs, which is a tax on a product made abroad, introduces a huge problem to companies. They will either have to decrease their profit or increase the prices of their products which will decrease the demand for their products.

The increased tariff makes people less likely to buy them since their prices will most likely go up. The theory is that increased tariffs will drive people to buy local products, boosting their country’s economy.

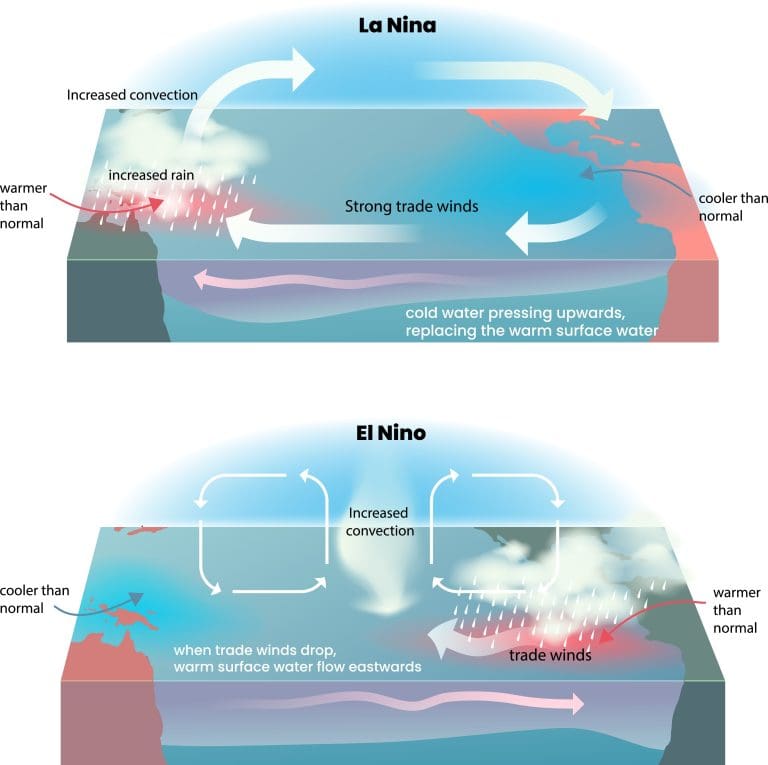

Many fear that this will spark a hostile trade war with China. A trade war, in simplest terms, is when countries try to attack each other’s trade with taxes and quotas. One country will raise tariffs causing the other to respond. This causes political tension and can damage both nations’ economies. President Trump, however, does not seem to care about rising political tensions and damaging economies.

On March 2nd 2018, he tweeted that “when a country (USA) is losing many billions of dollars on trade with virtually every country it does business with, trade wars are good, and easy to win. Example, when we are down $100 billion with a certain country and they get cute, don’t trade anymore-we win big. It’s easy!” This tweet shows how he’s had this idea in mind for quite a while.

Trump also wants to cut the trade deficit with China, a country that he’s been accusing of unethical trade practices since before his presidency.

Many believe that Trump’s plan will not be successful in the way he hopes and that the economy may be affected negatively for a while due to this decision.

Salma Almoradi (12) believes that “[she] does not believe Trump’s plan will work because he has not fully thought through his decisions and [she] hopes the economy will suffer too drastically for too long.”

The US steel industry may profit since the demand will increase. However, US companies that need raw materials, like car and aeroplane makers, will have an increase in production costs. This will negatively affect their customers who will have to see a rise in price in products. Items such as cars, plane tickets, and maybe even beer could see a increase in prices in the United States (BBC).